Why You Need a Bank Reference Letter

Bank reference letters came about as a way to check a person’s or business’s credit standing before credit reports existed. While credit reports have mostly replaced the need for bank references due to their level of detail, bank references can still prove useful.

For example, if a supplier needs to determine the line of credit for a new customer, a bank reference can help inform their decision when other credit history details are lacking.

What Needs To Be in a Bank Reference Letter?

For a bank reference to effectively serve its purpose, it needs to include key information about the issuing bank and the account holder.

Personal Information

This includes everything you’ll need to verify the identity of the account holder, like their legal name, a government-issued ID number, and their address.

If the bank reference is being provided for a business, it will need to include the business’s legal name, incorporation number, and the country it’s registered in.

Bank Information

The issuing bank will also identify its own information so that it can be easy to follow up with. The bank should cite its name and address, the name of the account manager, and the account manager’s contact information.

Account Information

This section will identify how old the account is, the type of account, and the balance. Sometimes the balance will represent its current value; other times it will represent the average monthly value.

Your account information will also likely include notable account activity, like any loans the account has received and its repayment history. These details are used as evidence to support whether or not the applicant is worthy of a similar account.

Endorsement of Account Holder

Finally, the bank will provide its endorsement of the account holder. The language is often intentionally broad in nature to protect the bank from a potential lawsuit. Rather than offering a direct yes or no answer, the letter will call out whether you’ve been trustworthy or acted in a respectable manner, leaving the recipient to fill in the blanks.

How To Request a Bank Reference Letter

Banks won’t provide a bank reference letter without the approval of the account holder, so whoever that is will need to be involved. Since bank reference letters are a common occurrence, submitting the application form to the bank as well as any required fee is often all it takes.

Sometimes the business needing the reference can make the request, but the bank will still need the account holder’s permission before taking action. In these instances, the account holder will either need to complete a separate consent form or wait to be contacted by their bank.

Here’s a sample letter that can be used to request a bank reference letter:

Hello [Contact Name],

We would appreciate it if you could arrange to provide us with a bank reference letter. The following information should be included in the letter:

- Date of account opening

- Type of account

- Average balance during past [Number] months

- Amount of line of credit

- Expiration of line of credit

Please ensure that the letter is delivered on bank letterhead, signed by a bank officer, and addressed to [Company Name]. A copy will not be accepted.

Sincerely,

[Signature]

Here’s a sample bank reference letter:

Re: [Customer Name]

Hello [Contact Name],

We hereby confirm that [Customer Name] of [Full Address] is a customer in good standing of [Bank Name]. Our records state [Customer Name]'s date of birth to be [Date of Birth].

[Customer Name] has maintained a [Checking/Savings] account with [Name of Bank] since [Date]. Average account balances for the past [Number] of months has been [Amount of Checking Balance] and [Amount of Savings Balance].

We provide [Customer Name] with a line of credit of [Dollar Amount]. At this time, there is [Dollar Amount] outstanding. This line renews on [Date]. All loans provided by [Bank Name] have been handled as agreed.

We confirm that [Customer Name] has held their accounts in a respectable manner and is, in our opinion, good for your figures.

Sincerely,

[Bank Officer Signature]

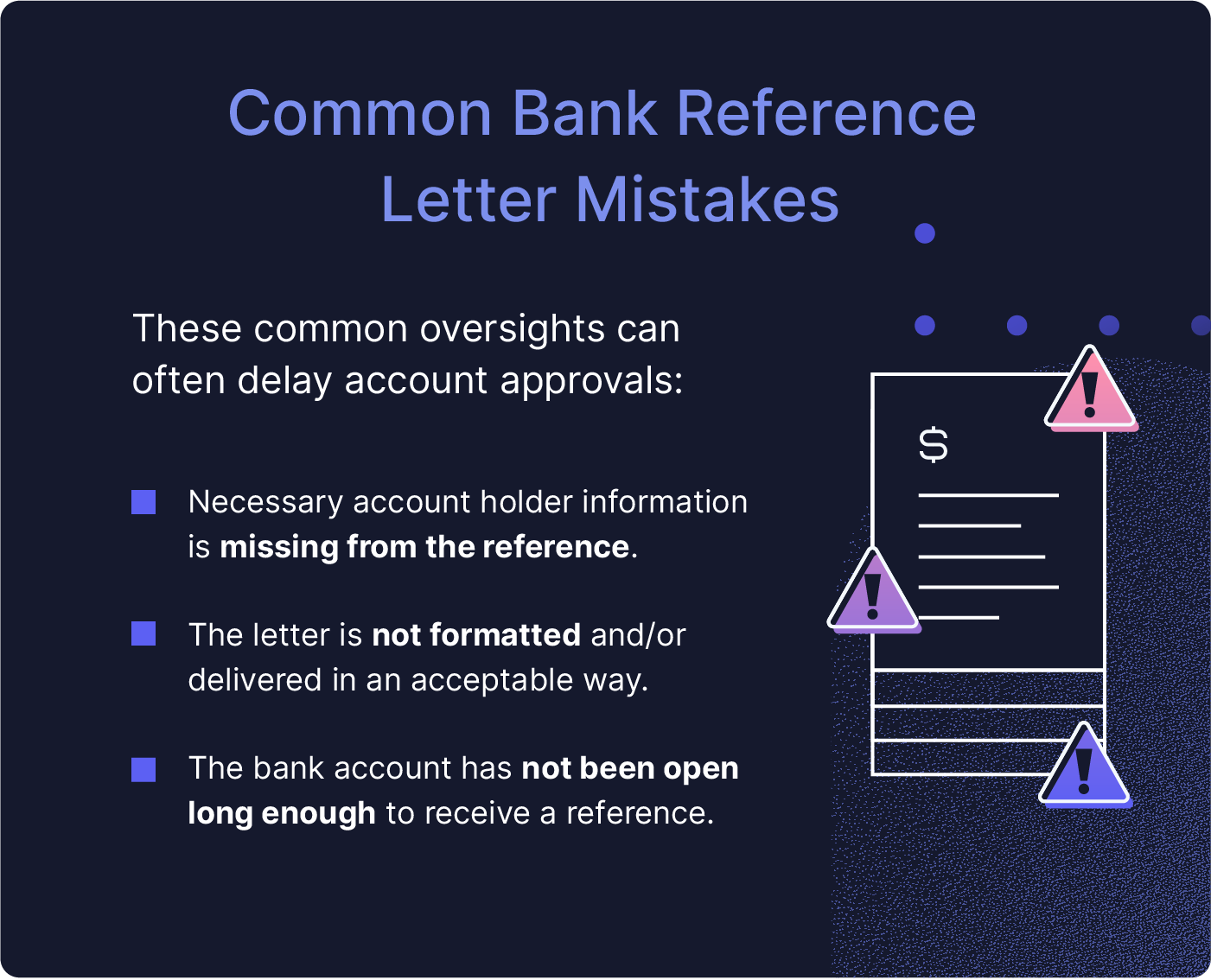

Mistakes To Avoid When Requesting a Bank Reference Letter

Getting a bank reference letter should be an easy task, but you’ll still want to avoid some common pitfalls:

- Get the details right: Even though most professionals are aligned on what a reference letter should include, some organizations expect more than others. Ask whoever is making the bank reference letter request for the specific information they’ll need.

- Confirm the formatting: Make sure that the bank producing the letter will deliver it in a condition that is acceptable to the requestor. Ask questions like if the color of the ink or paper matters, who the letter should be addressed to, or if it can be delivered electronically.

- Give yourself enough time: Don’t expect to be able to open a new bank account and use it as a reference that same day or even that same month. Many banks will require the account to be at least six to 12 months old before it is eligible for a reference so that they have time to vet you.

Getting these details settled before initiating the process will save you time and money if it can prevent you from having to repeat any steps along the way.

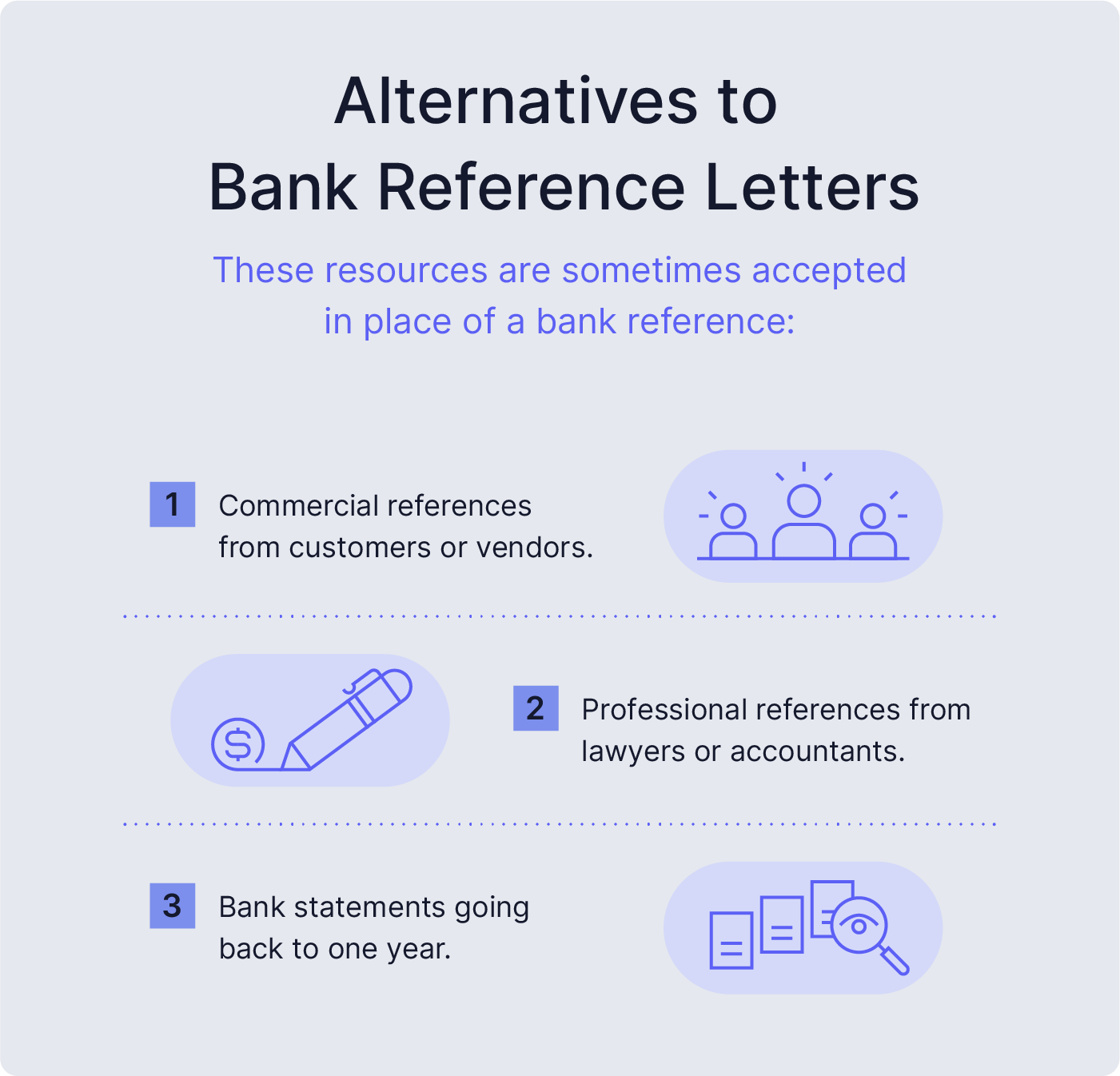

What Can Be Used in Place of a Bank Reference Letter?

A bank reference letter isn’t the only way to vet whether or not to extend credit to someone. Some vendors and banks allow alternative resources to satisfy this criteria.

- Commercial reference: Getting a reference letter from a customer or vendor can serve the same purpose of a bank reference by backing up one’s claim of being a reliable professional.

- Professional reference: In lieu of a customer or vendor, a letter from a business associate may also suffice. A lawyer or accountant can vouch for the state of someone’s finances and lend credibility to their claims.

- Bank statements: Some businesses accept recent bank statements, as it gives them a similar perspective regarding someone’s financial status. Depending on the business’s requirements, they may need statements going back only a few months, or they may need more than a year’s worth.

These alternatives should not be seen as universally interchangeable — some organizations may require a bank reference letter without any exceptions.

If you have a use for bank reference letters in your operations, use the best practices laid out in this guide to improve your processes. Check out our offerings for more help streamlining your credit application system, including vetting potential partners to extend credit to.

Bank Reference Letter FAQ

Take a look at these answers to commonly asked questions regarding bank reference letters.

What Are the Costs Associated With a Bank Reference Letter?

Some banks will not charge their customers for a bank reference letter, including the service as a perk of doing business with them. Banks that charge for the service will likely add a reasonable fee of around $10 to $15.

Can You Get a Bank Reference Letter From an EMI or Fintech Account?

Unfortunately, most electronic money institutions (EMI) and fintech accounts do not issue bank reference letters. Account holders will usually need to open a traditional bank account to receive this service.

How Long Does a Bank Reference Take?

A bank will often be able to produce a reference letter in as little as one to three days. It can then take another one to three days to mail the letter. To be eligible for a reference letter, the account with the bank will typically need to be at least six months old.

.png)