Your business credit score is more than just a number. It can shape how your company grows and expands in the future, so it’s essential to understand what the different business credit score ranges mean and where your score falls.

Nuvo works with suppliers and buyers to streamline the credit application process and understands the role of business credit scores in moving a business forward. Read on to better understand your business credit score and how to improve it.

A business credit score is essentially the same as a consumer credit score, but the score signifies the risk associated with lending to a business rather than a person. Even if you are the sole proprietor of your small business, your business credit score is tied to your Employer Identification Number (EIN), not your Social Security number.

Lenders use this number to evaluate whether to extend you a loan, and suppliers will check it, along with a bank reference letter, before offering you credit.

Like a consumer credit score, the higher a business credit score, the more likely it is to be approved for funding, whether it’s a small business loan or a contract with a vendor. However, the individual scores vary depending on which reporting bureau you consult. (Business credit score reports are not standardized like consumer credit reports.)

Experts recommend learning which bureaus your industry prefers and then working with vendors and suppliers who report to those bureaus to build your business credit.

Let’s break down what makes a good score for each of the four main business credit score reporting bureaus.

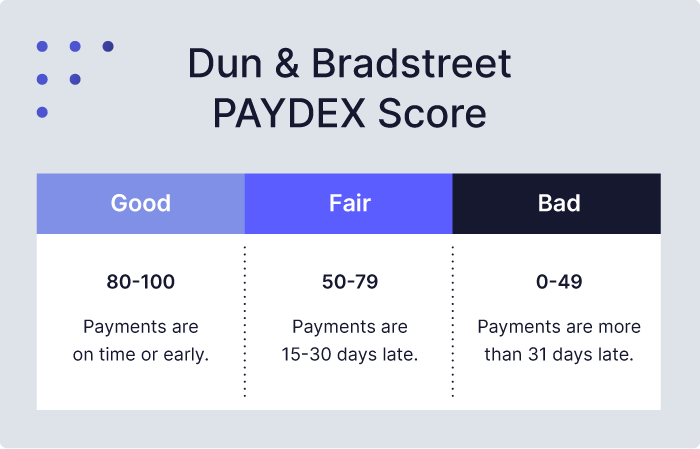

1. Dun & Bradstreet (D&B) PAYDEX

Dun & Bradstreet is one of the oldest business credit bureaus. Its main score is the PAYDEX score, which is a score of 1-100 indicating a business’s risk of late payments:

- 80-100: Payments are on time or early.

- 50-79: Payments are 15-30 days late.

- 0-49: Payments are more than 31 days late.

In addition to the PAYDEX score, a Dun & Bradstreet report also includes two other metrics:

- The failure score highlights how likely the business is to face bankruptcy or closure within the next 12 months. The lower the score, the higher the likelihood.

- The delinquency score reports the risk of seriously late (91+ days) payments. The lower the score, the less likely seriously late payments are.

To receive a Dun & Bradstreet score, you’ll need a D-U-N-S Number, which you can get for free through their website.

2. Equifax’s Small Business Credit Report

Equifax is one of the three main consumer credit bureaus, but it also offers a business credit report. In this report, you’ll find:

- A business credit risk score, which is a scale of 101-992 that rates a business’s likelihood for delinquency on payments

- A business failure score, which is a scale of 1,000-1,880 that reflects a business’s likelihood of closure within 12 months due to bankruptcy

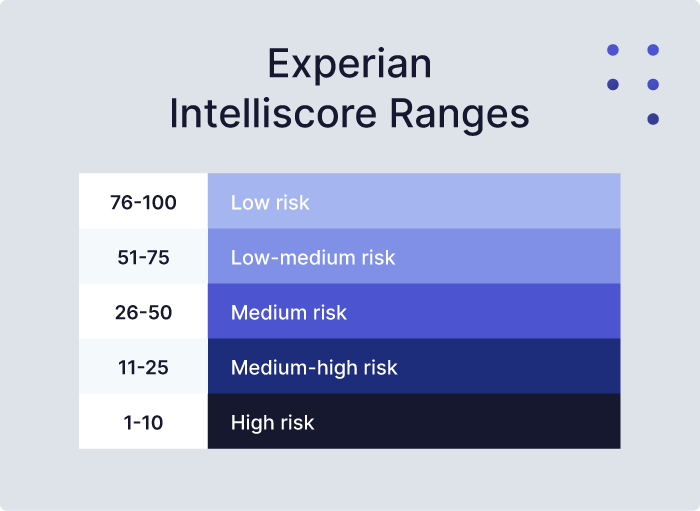

3. Experian Intelliscore

The Experian Intelliscore breaks down a business’s risk of late payments or defaults on a loan in the next 12 months using a scale of 1-100. Unlike the other business credit reporting bureaus, Experian does factor in the owner’s personal credit score.

Experian Intelliscores are broken down into five risk classes:

- 76-100: low risk of late payments or default

- 51-75: low-medium risk of late payments or default

- 26-50: medium risk of late payments or default

- 11-25: medium-high risk of late payments or default

- 1-10: high risk of late payments or default

4. FICO Small Business Scoring Service (FICO SBSS)

The FICO SBSS factors a business’s Dun & Bradstreet PAYDEX score, Equifax Small Business Score, and Experian Intelliscore into one score out of 300. The higher the score, the less risk is associated with lending money to the business. If you are looking for a Small Business Association (SBA) 7(a) loan, you’ll need a score of at least 160 for approval.

Unlike the other three reports, only banks and other lenders like the SBA have access to this report — not small businesses themselves. You cannot access your report directly from FICO, but you may be able to find it online through reputable data sources.

Similar to consumer credit scores, your business credit score is based partly on:

- Payment history

- The amount of money owed

- Length of credit history

- New credit inquiries

- Credit utilization rates

Unlike consumer credit, however, business credit score bureaus look at a few additional variables:

- Public financial records (if applicable)

- Business demographics (including the business size, standard industrial classification (SIC) codes, years in business, etc.)

- Industry risk levels (for example, restaurants are riskier than health care businesses)

- Your personal credit (depending on the reporting bureau or how long you’ve been in business)

.png)