5 Steps in the Dunning Process

Follow this dunning process to keep your ducks in a row and ensure no delinquent accounts fall through the cracks.

1. Identify Overdue Accounts

Sort through all customer accounts using an accounts receivable (AR) aging report. This should be an automated process in your AR software that quickly collects past due invoices and identifies how many days overdue they are and the existing balances. Your business can decide whether it’s better to contact accounts that are most overdue first, or if you want to prioritize those with the greatest balances.

2. Set a Distribution Schedule

It’s important to contact customers regarding their overdue payments to keep it top of mind, but you’ll want to space out your dunning letters so that they don’t come across as harassment. A popular approach is a 30-day cadence, with the dunning cycle beginning on the day after the scheduled due date. The next letter would be sent 30 days later, and so on and so forth until the cost of labor for your team equals the amount of the outstanding balance. In that event, most businesses will send the delinquent customer account to collections.

3. Write the Dunning Letters

It’s important to tailor your dunning notices with the specific account information, but you also should change the format based on how overdue the invoice is. The first couple letters should be polite, bringing awareness to the overdue invoice and allowing for the possibility that it’s due to a simple mistake. Following emails can be more direct, calling out any late fees that are being applied. The final letter should have the most urgency, warning the customer of when the delinquent invoice will be sent to collections.

4. Send the Dunning Letters

Verify that all the information contained within the dunning letter is accurate and ensure that the customer contact information is current. Sending a notice to an old address or dead email account is a common error and will lead to more complications down the road. Having a senior member of the AR team review the information can help avoid this.

5. Collect Payments and Reconcile Accounts

As payments start to roll in, it’s important to resolve the overdue invoice in your AR system to close that particular dunning cycle. In some instances, customers may respond, but rather than make a payment, they’ll dispute the charge. How you handle these disputes will depend on your company policy, and the current dunning cycle should respond accordingly.

How To Write a Dunning Letter

How you phrase your dunning letter will depend on how far overdue the payment is. Getting the wording right will help preserve your working relationship with the client while conveying the appropriate amount of urgency.

Your first dunning letter should be cordial, leaving room for the possibility that the invoice fell through the cracks. For instance:

This is a reminder to pay [Amount Due] for invoice [Invoice Number] which was due on [Due Date].

Please contact us immediately, even if you believe you’ve already paid, so that we can settle this matter.

The invoice is attached for easy reference.

Thank you for your cooperation on this matter,

[Your Name]

Your second and third attempts can increase in sternness, driving home the importance of the overdue payment.

This is our [second/third] attempt to reach you concerning invoice [Invoice Number] for which you still owe [Amount Due]. This payment was due on [Due Date] which is now [30/60] days overdue.

Please contact us immediately, even if you believe you’ve already paid, so that we can settle this matter.

As agreed upon in our payment terms, a late fee of [Amount of Late Fee] has been added to your account.

The invoice is attached for easy reference.

Thank you,

[Your Name]

Your fourth attempt should focus on the repercussions the customer will face if they do not follow through with the payment.

This is our fourth attempt to reach you regarding invoice [Invoice Number] for which you still owe [Amount Due]. This payment was due on [Due Date] and is now 90 days overdue.

A late fee of [Amount of Late Fee] has been added to your account.

If we don't receive payment from you, we will be forced to enter a formal collections process. If you have any questions or need to arrange an alternative method of payment, please contact us immediately.

Regards,

[Your Name]

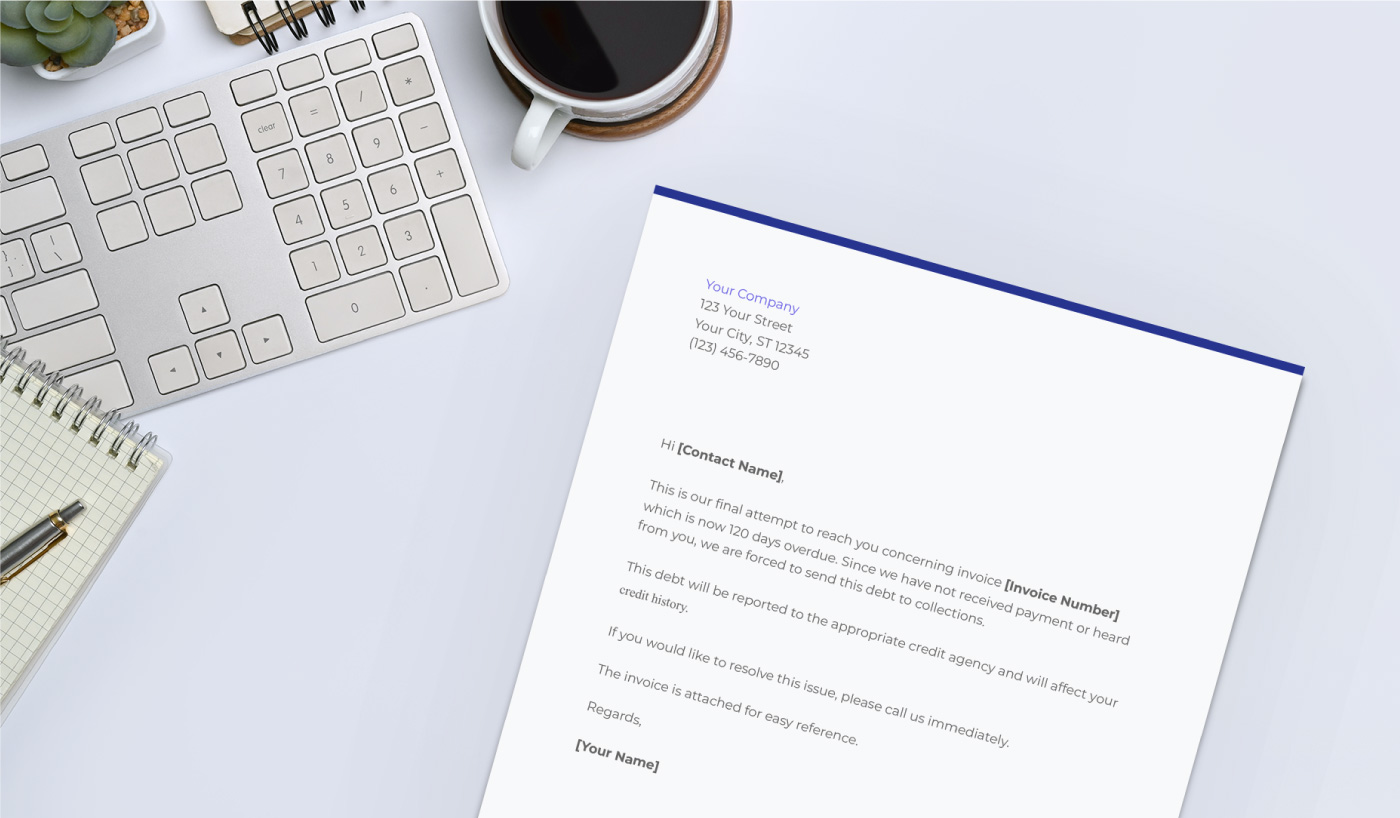

The final attempt can be frank about the state of their account and the next steps your company will take.

This is our final attempt to reach you concerning invoice [Invoice Number] which is now 120 days overdue. Since we have not received payment or heard from you, we are forced to send this debt to collections.

This debt will be reported to the appropriate credit agency and will affect your credit history.

If you would like to resolve this issue, please call us immediately.

The invoice is attached for easy reference.

Regards,

[Your Name]

The next steps you cite will depend on your company policies and the payment terms the customer agreed to.

6 Tips for Improving Dunning Letter Processes

Sick of having low open rates and poor response numbers? Get the best results possible from your dunning letters by incorporating these best practices into the process.

1. Reach Out Through Different Mediums

Each customer likely has a preferred method of communication, and that should be your first means of initiating contact. However, if the first dunning letter receives no response, it can be beneficial to use a mixture of other mediums to increase your chances of getting a response.

For instance, if you send an email to an employee who is no longer with the company, you likely won’t get a response if those emails aren’t being forwarded to someone else. Sending an identical physical letter or following up with a phone call can give you verification that your messages are getting through.

2. Customize Each Message To Convey Urgency

If you use identical language in your dunning letters, only changing the number of days the invoice is overdue, then you risk having the customer mistake a new notice for a previous one, or they may not think the situation is as serious as it truly is.

Differentiating the phrasing and tone helps each letter stand out in the mind of the recipient and prompts a suitable response.

3. Identify What the Customer Will Lose if They Don’t Pay

Motivate customers who are prone to procrastination by identifying what will happen if they don’t resolve their outstanding payment. In early dunning letters this may mean announcing when an account might be frozen or when a late fee will be added.

Later letters can call out when the unpaid bill will be sent to a debt collector. Knowing that they stand to lose more by delaying a payment may lead the customer to take action.

4. Keep It Personal

Spamming customers with boilerplate emails or letters is a good way to have your dunning notices sent directly to the trash bin. Adding personality to the notices can grab their attention and remind them they’re dealing with real people at your company, which most people prefer over bots. Making phrasing more conversational or adding emojis are just a couple of ways to accomplish this.

5. Propose Alternative Ways To Keep Accounts Open

Sometimes there are better alternatives to closing a customer’s account after a failed payment. For example, if your business offers different plans, you could choose to downgrade them to the free tier to retain them as a customer without risking further losses.

Alternatively, you can choose to offer a discount or special deal if they make good on their payment. This is a great option for loyal customers who simply forgot to update their billing information and have otherwise been prudent.

6. Automate Processes

Thanks to advances in technology, much of the tedious dunning letter tasks can be lifted from your employees. You can create templates for every stage in the dunning process and schedule them to automatically send out to customers at strategic times.

Even the most skillfully crafted dunning letter can be damaging to your relationships with customers. Using a service that can personalize credit terms, like Nuvo’s credit risk assessment, helps ensure your business is only offering lines of credit that your customers can afford.

Dunning Letter FAQs

Check out these answers to common questions related to dunning letters.

Why Is It Called a Dunning Letter?

The term originated in the 17th century when the word “dun” was used when demanding the payment of a debt.

What Are Dunning Rules?

Dunning rules describe the actions that will be taken when an invoice becomes overdue. Common dunning rules include defining when a late fee will be applied and for how much, when the account status will change, and how the account holder should be contacted.

When Should You Send a Dunning Letter?

A dunning letter can be sent out the first day following a missed payment. The frequency in which dunning letters are sent may vary based on the individual company’s policy, but they are commonly sent every 30 days the account remains delinquent.

.png)