Accounts receivable departments play an important role in the overall success of any business. Keeping your team optimized can lead to improved customer relations, improved revenue, and improved competitiveness. But knowing how to do that can be difficult without a proper frame of reference.

Use these accounts receivable statistics to gauge how your department matches up to others and identify where you can stand to improve.

Communication Is Key for Preventing Customer Conflict

It can be easy to let customer service take a back seat when you’re busy sending out invoices and chasing down payments. Many executives are starting to realize how focusing on the bottom line at the expense of customer relationships can be self-defeating. A greater emphasis is now being placed on communication during the AR collections process in an effort to retain customers and improve their compliance to payment terms.

1. In 2022, 78% of executives believed better communication could have resolved accounts receivable payment disputes. (Wakefield and Versapay)

2. 72% of executives felt their AR department wasn’t customer-oriented enough. (Wakefield and Versapay)

3. 42% of executives reported having lost business multiple times due to miscommunication. (Wakefield and Versapay)

4. 64% of executives claimed they’ve had invoice disputes lead to the threat or initiation of legal action. (Wakefield and Versapay)

5. In 2022, 41% of finance leaders considered the speed of payments to be the biggest challenge in their collections processes. (SSON and Versapay)

6. 35% of finance leaders cited difficulty communicating with customers as the biggest inhibitor in their collections processes. (SSON and Versapay)

Communication is just one aspect of a successful AR team. Now let’s look at how customer experience impacts success.

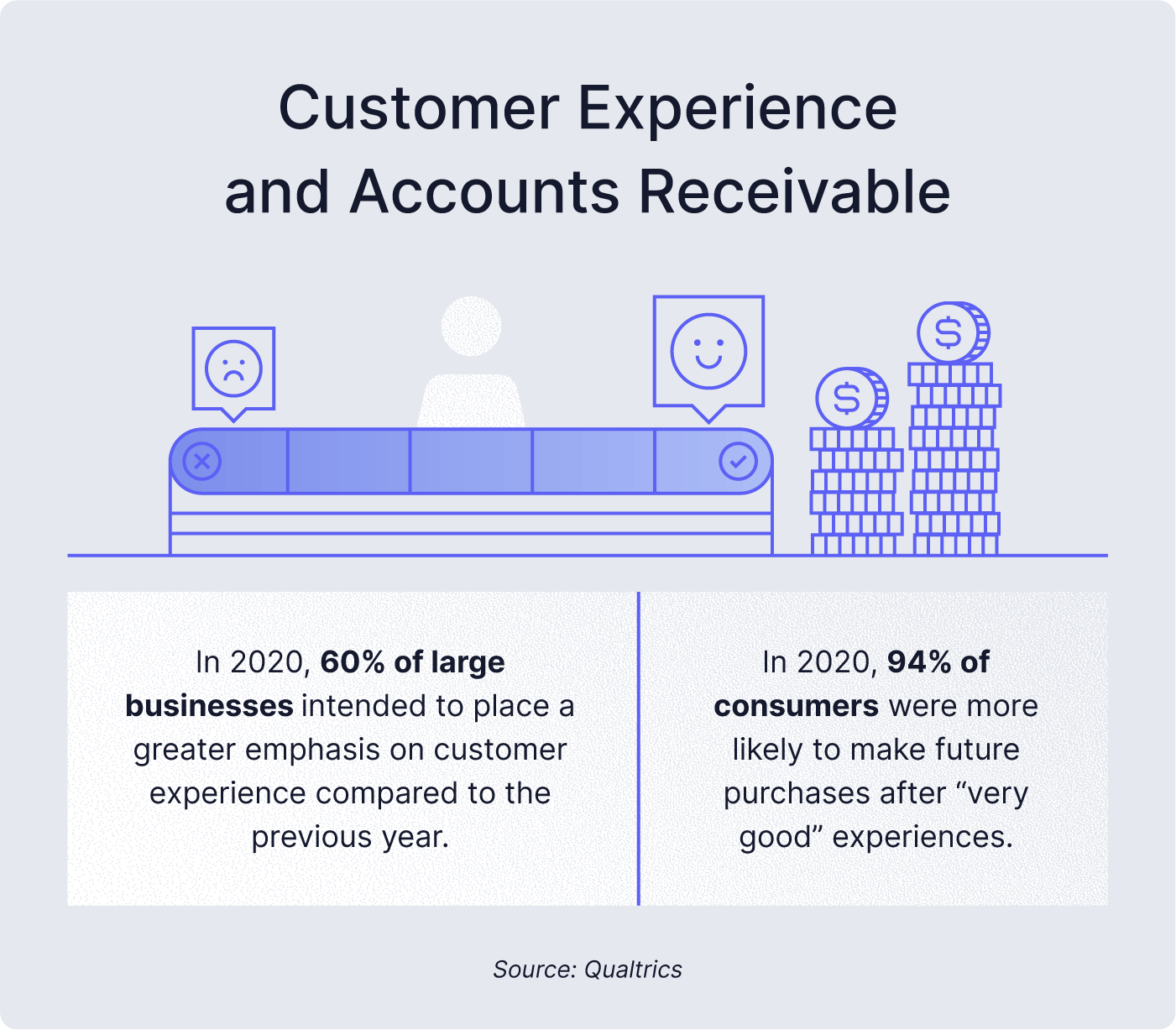

Customer Experience Plays an Important Role in Repeat Business

Communication isn’t the only area accounts receivable departments can stand to improve. Overall customer experience (CX) also plays an important role in the loyalty a customer feels to a business. Since retaining a customer is more valuable than attaining a new one, CX is a variable deserving of attention. These AR statistics show that executives acknowledge the importance of CX and are prioritizing it in their operations.

7. In 2020, 94% of consumers were more likely to make future purchases after “very good” experiences. (Qualtrics)

8. In 2016, 36% of customers who received electronic bills said they were less likely to switch to a competitor. (Fiserv)

9. In 2020, 60% of large businesses intended to place a greater emphasis on customer experience compared to the previous year. (Qualtrics)

10. In 2022, 53% of finance leaders considered customer experience to be “very” or “extremely” important. (SSON and Versapay)

11. In 2015, companies that excelled at delivering on customer experience grew their revenues between 4% and 8% more than their competitors. (Bain and Company)

As your customer experience improves, you may be able to avoid common AR mistakes.

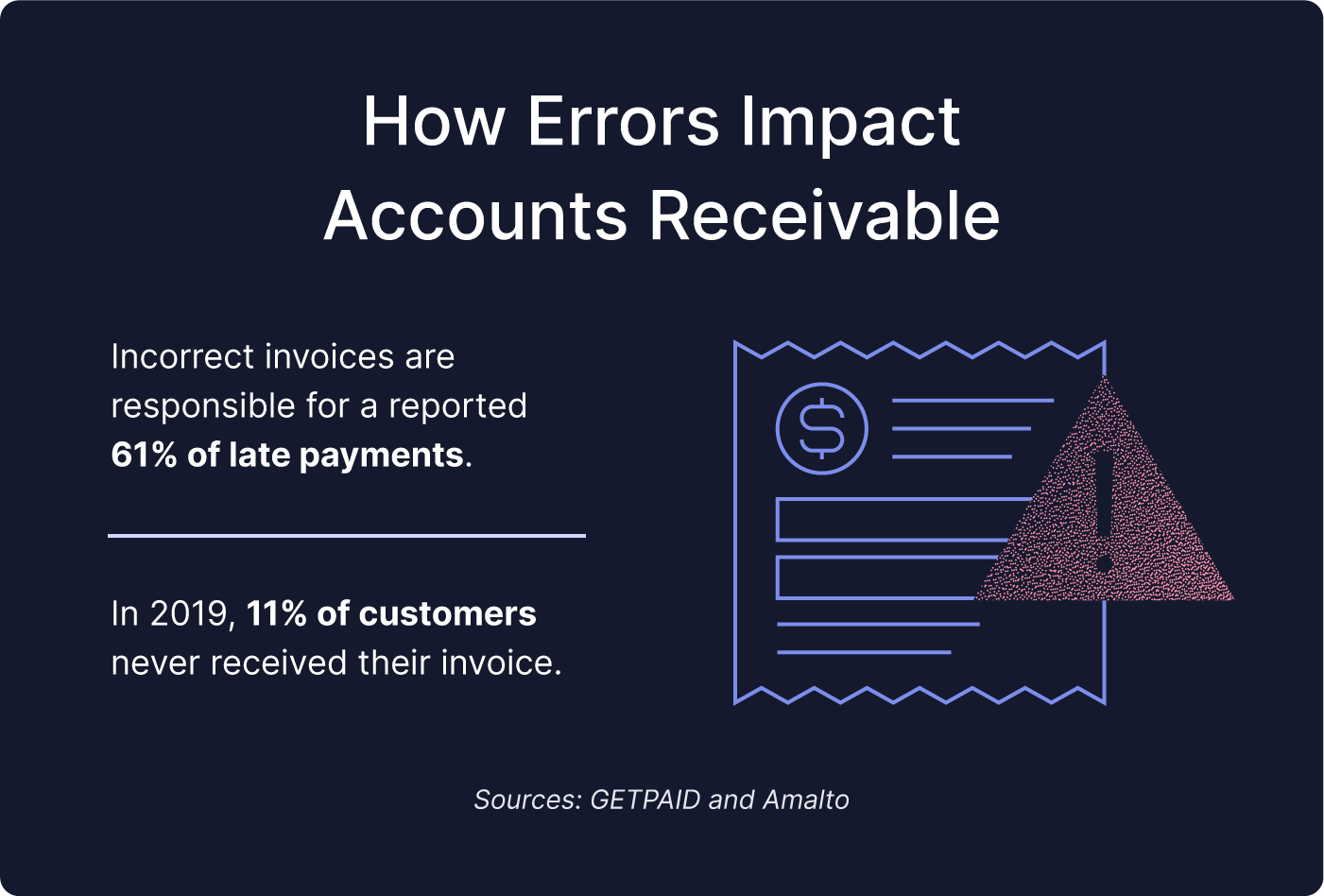

Small Errors Add Up to Big Expenses

While it can be tempting to place the blame for late payments on customers, the reality is that internal errors are often responsible for outstanding accounts receivable. Ensuring invoices are accurate and actually make it to the customer will reduce the amount of time team members spend on collections. Cutting down on these errors can have a positive impact on the money you spend resolving disputes and can prevent those invoices from contributing to your bad debt rate.

12. Incorrect invoices are responsible for a reported 61% of late payments. (GETPAID and Amalto)

13. In 2019, 11% of customers never received their invoice. (GETPAID and Amalto)

14. On average, 4% of AR collections were written off as bad debt in 2019. (GETPAID and Amalto)

15. On average, it cost $53.50 to reconcile errors on paper invoices in 2010. (Sterling Commerce)

16. In 2022, 16% of AR teams still manually matched payments and remittance data. (SSON and Versapay)

Many of the errors AR teams come across will be things of the past as companies embrace the digital landscape.

Customers Want Businesses To Go Digital

Connecting with customers where and when they want works hand in hand with delivering a great customer experience. Customers are increasingly expecting businesses to have a digital presence both for the convenience and flexibility it provides them. These accounts receivable statistics back up how incorporating AR software into a business’s processes can be mutually beneficial.

17. In 2020, 88% of customers expected businesses to increase their digital initiatives. (Salesforce)

18. In 2016, nearly three-quarters of consumers said their satisfaction with a company could be improved by being offered multiple billing and payment options. (Fiserv)

19. 79% of consumers expected large national companies and local service providers to have the same payment options. (Fiserv)

20. Between 2015 and 2018, the number of non-cash payments increased by 30.6 billion. (Federal Reserve)

21. Between 2015 and 2018, the number of check payments fell 7.2%. (Federal Reserve)

22. In 2020, businesses that used manual AR processes took 67% more time handling overdue payments than those that had automation. (PYMNTS.com and American Express)

23. In 2022, 67% of AR teams reported using email to communicate with customers the most. (SSON and Versapay)

As more companies digitize their AR departments, automation is the natural next step. Let’s take a look at how that will impact the field going forward.

Trends Accounts Receivable Departments Are Experiencing

Manual processes are often a pain point for organizations, slowing down tasks and leading to avoidable errors. As businesses take their AR departments digital, they’re also reaping the rewards of automation.

24. Between 2021 and 2031, the employment of bookkeeping, accounting, and auditing clerks is expected to drop by 5%. (U.S. Bureau of Labor Statistics)

25. The global market for accounting software is expected to reach $19.59 billion by 2026. (Reasearchandmarkets.com)

26. In the United States, 39% of invoices were paid late in 2019. (GETPAID and Amalto)

27. 57% of finance leaders cited automating AR functions as a major goal in 2022. (SSON and Versapay)

28. In 2022, 44% of executives believed AR digitization led to better communication with customers. (Wakefield and Versapay)

29. In North America, the use of trade credit increased 9% in the year following the COVID-19 pandemic. (Atradius)

30. In 2020, it took more than 20 days for 80% of businesses to collect outstanding receivables. (Forrester and GoCardless)

31. In 2020, businesses had an average DSO between 20 and 30 days. (Forrester and GoCardless)

With these statistics in mind, you might want to look at some ways to level up your current AR processes.

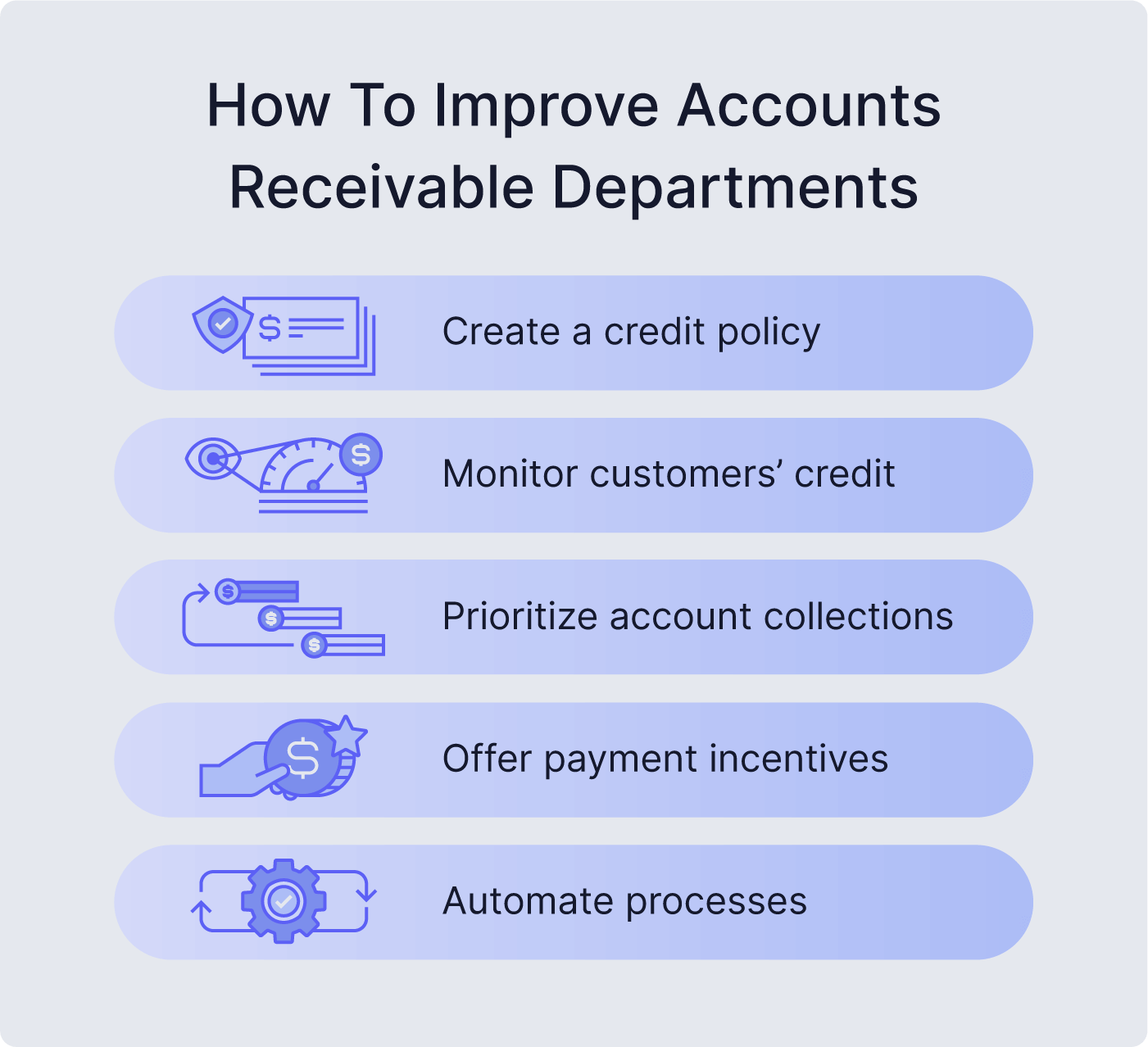

Ways To Improve Accounts Receivable Practices

If you’re worried your accounts receivable department is falling behind your competition, here are six ways to give it an edge:

- Create a credit policy: A credit policy provides your team with an official procedure for how to issue credit to customers. A comprehensive policy aligns everyone in the department, identifying their roles and providing guidance on how to execute their responsibilities, such as who is responsible for AR collections.

- Monitor customer activity: After approving a customer’s line of credit, keep an eye on their activity to find out if their finances change for the better or worse. Some services, like Nuvo, can handle this for you, providing alerts when notable changes occur.

- Review customer account information: Many past due invoices result from the customer never receiving it in the first place. Ensure you have accurate contact information by periodically requesting that customers update it. This can include phone numbers, emails, and physical addresses.

- Prioritize account collections: The longer an invoice remains overdue, the less likely it is to be paid. Act quickly when due dates pass, but also identify accounts that are high priority and give them special attention. The largest payments are often given the highest priority.

- Offer payment incentives: Encourage customers to honor their payment terms by offering discounts for early payments. For example, if you offer 30 days to pay an invoice, you can offer a 3% discount if they pay in 15 days, increasing the collectibility of accounts receivable.

- Embrace automation: Many manual errors can be avoided entirely by utilizing accounts receivable software that can automate tasks. This has the added benefit of increasing department efficiency in sending invoices and reconciling accounts.

Accounts receivable statistics may not hold all the answers for how to manage your department, but they do paint an interesting picture. Use them to inform your decisions and help your team navigate through this changing climate. And look to Nuvo for help automating your processes.

.png)